Finance Sustainable Buildings

Property Assessed Clean Energy Programs (PACE)

Facilitator

Short term

Mortgage focus shift changes the focus from the offered interest rates to the initial PACE programs, which allow a property owner to finance the up-front cost of energy or other eligible improvements on a property and then pay the costs back over time through a voluntary assessment. The unique characteristic of PACE assessments is that the assessment is attached to the property rather than an individual. 100% of the upfront costs are covered and it does not require personal credit. PACE is effectively a form of debt, with a lien attached to the property.

PACE requires a property ownership to participate, eligible improvements are based on the value of the property, and it is assessed on taxes (paid twice a year in large sums).

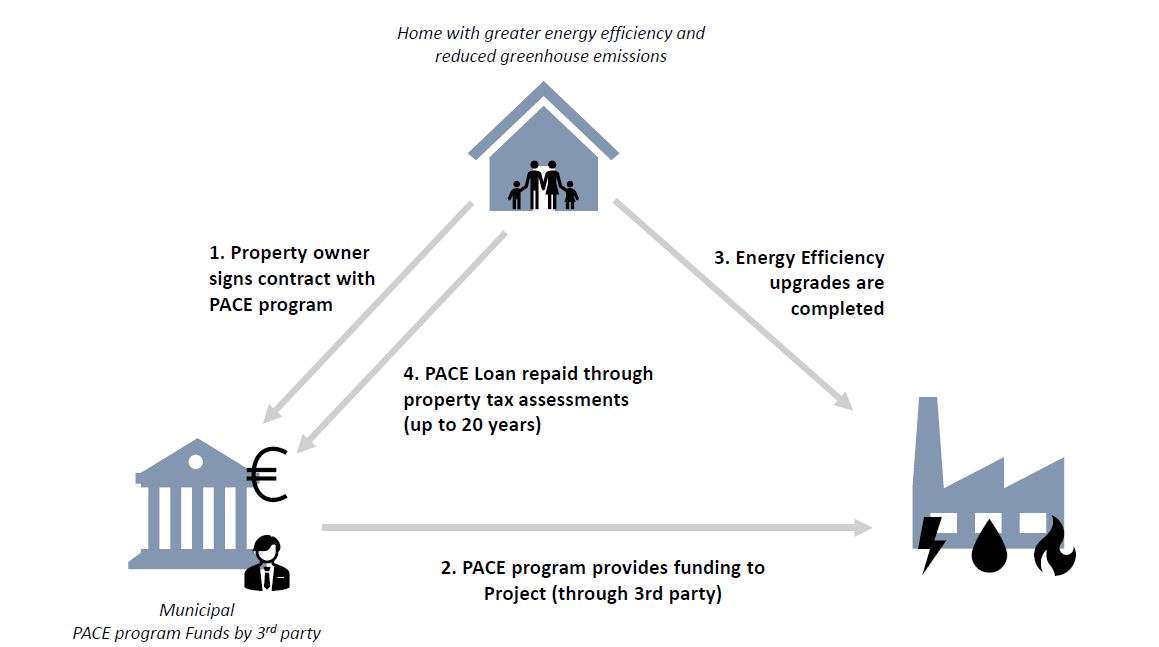

The process would unfold as follows:

Socioeconomic impacts

Some of the advantages that PACE program has are:

- Securing financing of comprehensive projects over a longer term and increase the amount of positive project cash flow;

- Spreading the repayment over many years, seldom will there be a requirement of an upfront payment, and removal of the requirement that the debt is paid at point-of-sale or during refinance;

- Deductible payments from income tax liability, allowance of municipalities to encourage energy efficiency and renewable energy without putting general funds at risk.

But there are also some disadvantages:

- The interest rates are higher than traditional loans;

- Sale of the property might be more challenging because of the assessment;

- Since the assessment is secured to the home, it increases the risk of foreclosure. Financing can be public or private or (large sources of private capital).

PACE financing is not yet available in the EU. Some impeding factors include complex legal processes and first-lien complications which must be best addressed at the EU level. In addition, PACE is normally based on bond issued by cities, which is not common in EU cities, especially small ones. However the pilot EUROPace is currently being developed.

Related to

Renovation Wave. For one-step deep renovation this instrument could be suitable as these retrofits are usually very expensive.

SER framework. Until now, this instrument has been implemented for Efficiency and Renewables but it is also applicable to Sufficiency.

Study Case: Property Assessed Clean Energy Programs (PACE)

EUROPace in Spain

The pilot project, EuroPACE is testing the concept in a municipality in Spain. EuroPACE adopts best practices from the US PACE market and intends to further enhance its impact. The project aims at addressing several fundamental challenges to EE investment. The first ambition is to deploy private capital as up-front financing to homeowners (IEA-RETD), that is, reduce reliance on grants and subsidies; a de-risk approach to EE investments is the second aim. To optimize the decision-making processes for homeowners, the project includes the training of energy service contractors (technical assistance) and finally, it provides design standard underwriting requirements and project performance guidelines to facilitate the project aggregation and the issuance of Green Bonds.