Finance Sustainable Buildings

On-bill schemes

Facilitator

Short term

The core feature of an on-bill scheme is the involvement and active role of the utility company supported by financing institutions in the energy renovation of residential buildings. The cornerstone of on-bill schemes is using the utility bill as the repayment vehicle for retrofitting or renovating residential buildings.

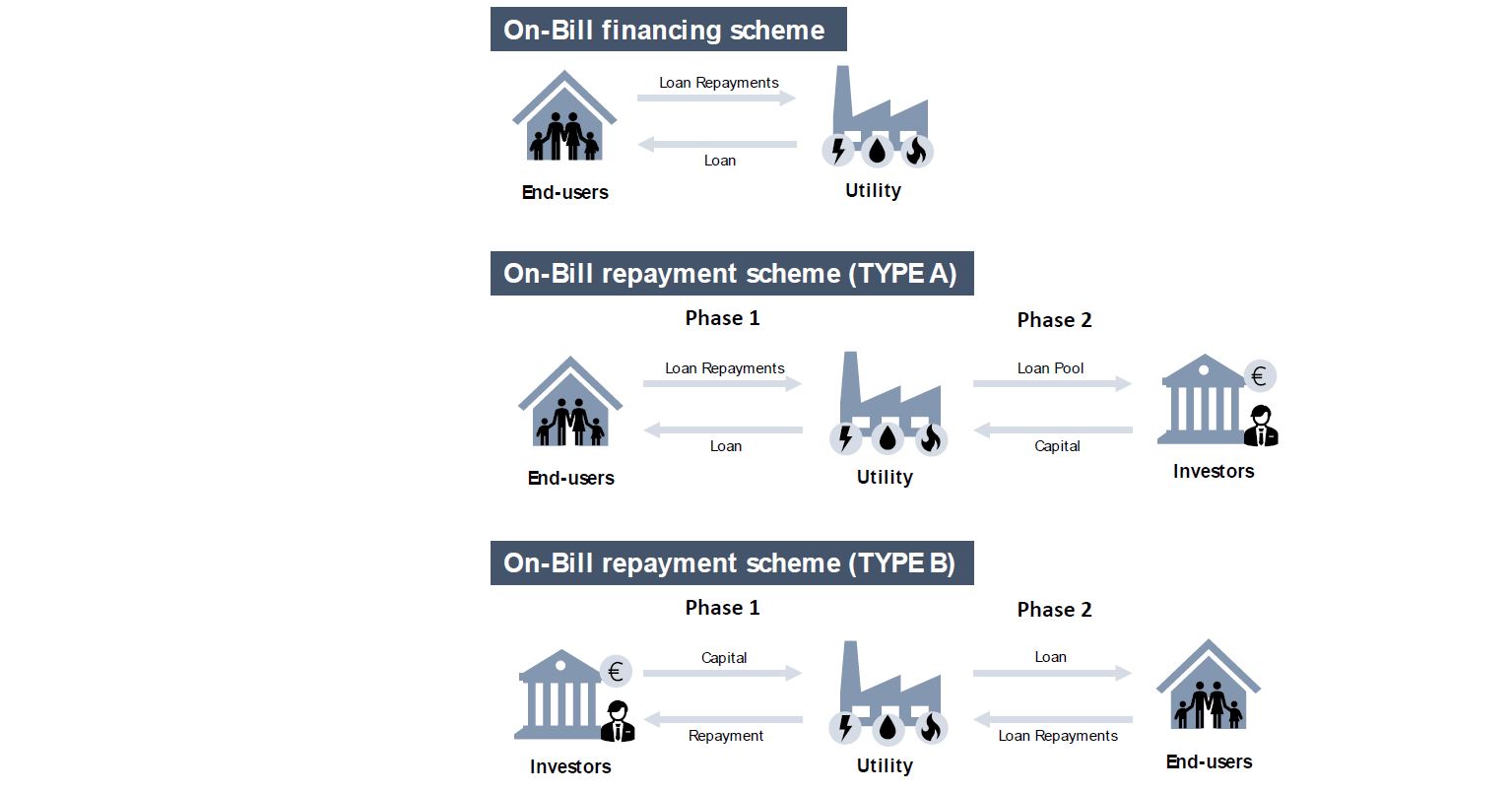

Based on the source of financing, there are two main mechanisms applicable to on-bill programmes: on-bill financing (OBF) and on-bill repayment (OBR). A typical On-bill Financing scheme represents an On-bill Repayment scheme where the utility company takes the role of the investor. Furthermore, there are two types of On-bill Repayment schemes: type A, where the utility company uses its own funds to finance the interventions, selling these loans to financial institutions in the second phase of the project; and type B, where the utility company raises private capital upfront.

Despite the fact that on-bill schemes can be structured to ensure “bill neutrality” (meaning that the projected energy savings offset the fixed monthly loan or tariff instalment), the European Consumer Organisation BEUC recommends that the amount of the repayment should not exceed the savings or be compensated by increased comfort instead.

Socioeconomic impacts

On-bill schemes are successful in resolving some of the typical barriers energy efficiency projects may face when implemented in residential buildings, such as:

- High upfront investment costs,

- Increased debt burden for families by overcoming upfront barriers,

- Low credit capacity and loan securitisation issues among end-users,

- Mobilising private capital, and

- Owner-tenant dilemma.

However, these schemes introduce end-user barriers as the incentives split between tenants and owners, where the benefits and costs of energy renovation are unevenly distributed. In short, owners tend not to invest in energy savings measures that primarily benefit tenants, while tenants are not willing to make investments in residential units they do not own. A way of overcoming split incentives for the utilities is to scale up this approach aiming at offering lower prices without diminishing sales targets.

Related to

This scheme will increase the available funds for retrofitting and renovation projects as part of the life cycle of buildings. This scheme overcomes upfront barriers faced by the owners of a real estate property.

Aiming at solving the owner-tenant dilemma, the EU member states should introduce owner-tenant laws that enhance the fair distribution of the investment costs, for example by using a share of the energy benefits for investment repayments and making the renovation investment equally appealing for both groups.

Provisions for protecting investors from default on the repayment of renovation costs while maintaining consumer protection should also be considered. Increasing credit protection would allow investors to relax their lending criteria, allowing much easier and more efficient uptake of on-bill schemes. For vulnerable groups of people, public authorities must act as guarantors in case of end-user default by implementing loan loss reserves and guarantee funds; this would replace potentially undesirable means of securitisation, such as grid disconnections.

Study Case: On-bill schemes

Manitoba Hydro Power smart residential loan programme, Canada

Manitoba Hydro offers its residential customers Pay-As-You-Save (PAYS) financing for eligible energy efficiency upgrades, notably for space heating, insulation, and water heating equipment. Monthly payments are added to the utility bill and are transferable to the next homeowner. Launched in 2005, this program supports around 5,000 participants per year, with approximately 6,000 USD of investment. Besides this, the program has a loan default rate equal to 0.48%, and on average a project saves 825 kWh/year, or 7.5% of energy used.

Among the supported interventions, there are: residential space heating equipment; insulation and residential water heating and conservation; drain water heat recovery systems; and water efficient toilets. The potential beneficiaries are residential customers of the Manitoba Hydro, with homes where energy improvements are made and have an active Manitoba Hydro account in good standing.

In this case, the capital for the on-bill programme comes from public money of the Manitoba government and lend to the Manitoba Hydro at low cost. The Manitoba government does not back any of the loans. The maximun term depends on the upgrade, but the most common terms go up to 20-25 years. The interest rate charged by Manitoba Hydro sits at 4.8%.

Key strengths were found upon this specific case. Relaxed underwriting criteria resulting in rejection rate of 5%, interest rates were kept relatively low, and a quick turnaround time for approval of around 48 hours. Additionally, this business model supported a limited range of interventions.