Finance Sustainable Buildings

Differential on-bill repayment scheme

Facilitator

Short term

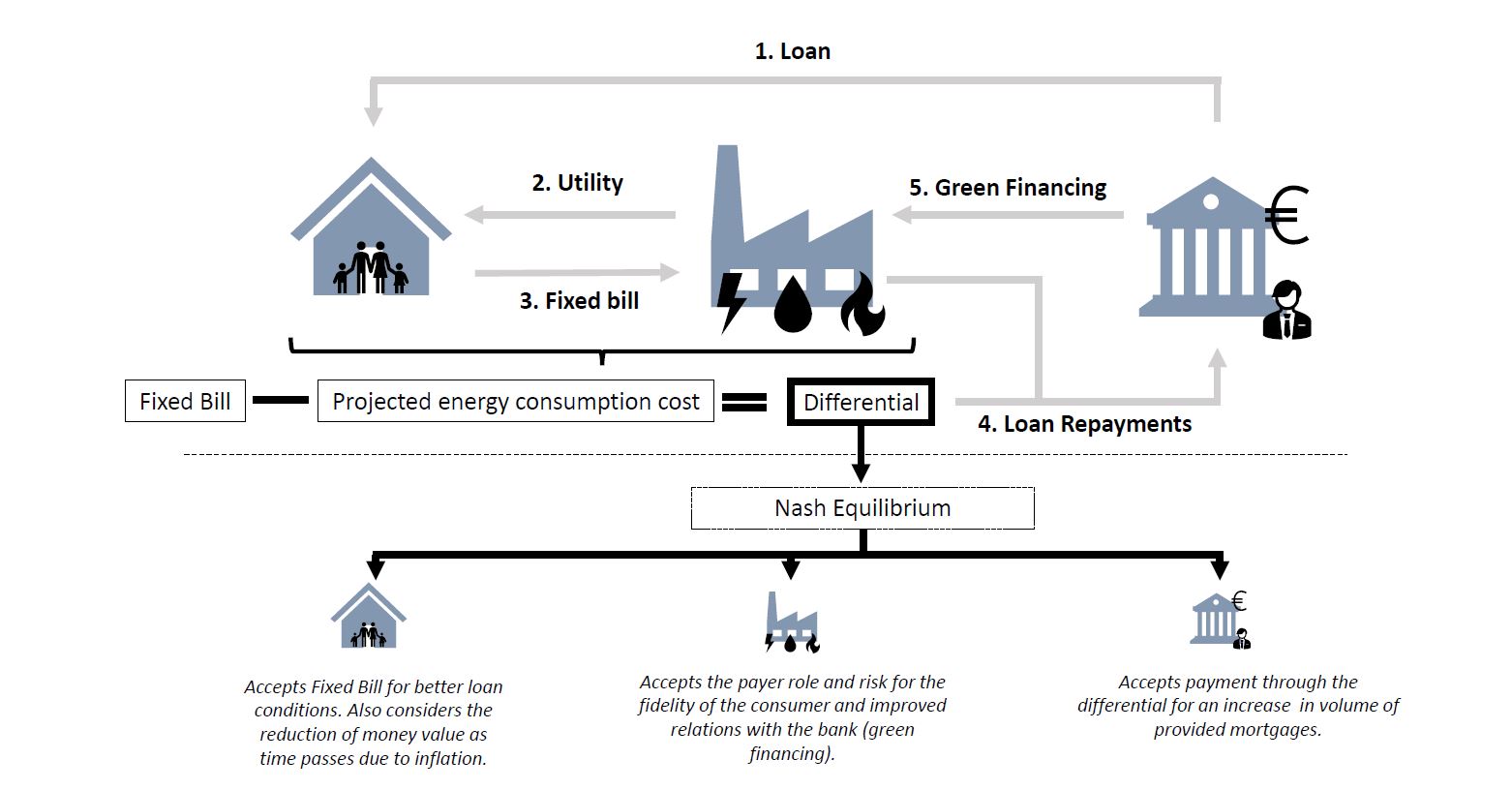

The differential model is based on Nash´ equilibrium. This game theory based instrument creates a differential between a fixed bill paid by the consumer and the projected energy consumption cost as consumption reduces due to efficiency. This differential is what would be used in order to pay back the loan provided from the bank to the family.

The main goal by this alternative type of on-bill scheme is the creation of a coordinated process between investors, utility providers and end-consumers that would promote renovations. Through this novel scheme, every agent knows how others should behave in order for the goal to be achieved and this is why it would only be possible if all agents cooperate. The process would unfold as in the image below.

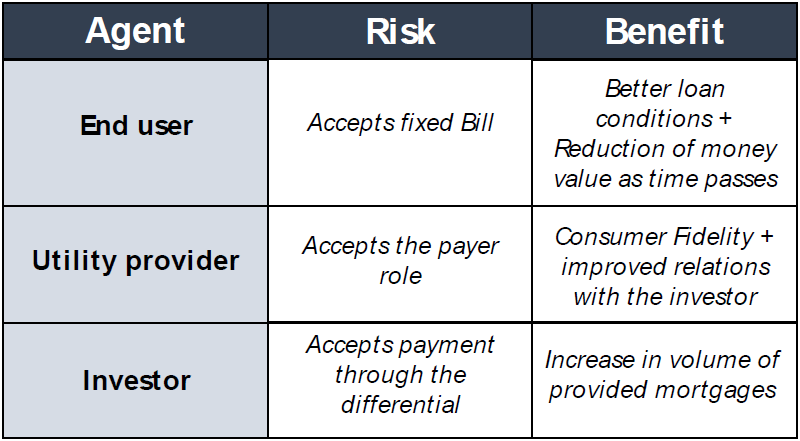

At first, the end user must accept a fixed rate for the energy bill paid to the utility provider. Then, as the consumption of the building reduces due to sufficiency and efficiency, a differential is generated with the fixed bill. This differential is what the utility provider would use to pay back the loan given by the investor. It is true that the utility provider is paying back the loan given to the end-user, however there are benefits as a consequence of this behaviour that are explained in the following table alongside the risk and benefits for all agents. Thus, every agent involved takes on a risk that would only become reality if any of the other agents fail to behave the “correct” way.

Socioeconomic impacts

This alternative scheme would facilitate accessibility to renovations to end-consumers, besides this it would also generate a triangle of responsibilities that would boost retrofitting and renovation plans at a local level. By making this game theory scenario possible, every agent commits not only to accept the mentioned risks, but also to generate positive externalities for the environment. Investors would promote renovation by facilitating credit to end users, end users would find environmentally proven renovations more attractive due to credit facilities and utility providers would increase their market share, which will be filled by environmentally friendly projects.

Related to

As the traditional on-bill schemes, this instrument will increase the available funds to retrofitting and renovation projects as part of the life cycle of buildings. This scheme overcomes upfront barriers faced by the owners of a real estate property. Furthermore, it solves the owner-tenant dilemma, introducing the Nash equilibrium as a way of overcoming this dilemma.